TELEPHONE EXPENSES

Every educator uses their mobile and/or home phone in their day care business. Where your phone is used exclusively for business, you can claim a deduction for all of the phone rental and associated calls. However if you use your phone for business and private calls, you can only claim a deduction for business calls and part of the rental costs.

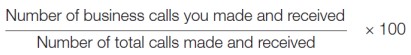

With capped mobile plans and fixed line rentals which include a certain value of calls as part of a package, it can sometimes be difficult to determine what portion of the call costs relate to either business or private. If this applies to you, then you may wish to use the following formula to identify your claim percentage.

On the other hand, if you pay a separate line rental and call costs (ie you receive an itemised account), you should use the above formula to work our your claim percentage for the line rental only, and then add up your individual business call costs to work out your claim.

In order to substantiate your claim percentage using the formula, you will need keep a diary or log record of calls made and received for a representative four-week period. Provided your usage for the rest of the year remains relatively the same (less than 10% difference), you can use this information to calculate your claim your telephone expenses for the entire year financial year.

Every educator uses their mobile and/or home phone in their day care business. Where your phone is used exclusively for business, you can claim a deduction for all of the phone rental and associated calls. However if you use your phone for business and private calls, you can only claim a deduction for business calls and part of the rental costs.

With capped mobile plans and fixed line rentals which include a certain value of calls as part of a package, it can sometimes be difficult to determine what portion of the call costs relate to either business or private. If this applies to you, then you may wish to use the following formula to identify your claim percentage.

On the other hand, if you pay a separate line rental and call costs (ie you receive an itemised account), you should use the above formula to work our your claim percentage for the line rental only, and then add up your individual business call costs to work out your claim.

In order to substantiate your claim percentage using the formula, you will need keep a diary or log record of calls made and received for a representative four-week period. Provided your usage for the rest of the year remains relatively the same (less than 10% difference), you can use this information to calculate your claim your telephone expenses for the entire year financial year.