Claiming Motor Vehicle Expenses

Practically all educators use their car for various day care purposes. Where you use the car that you own for day care purposes you may be entitled to a tax deduction.

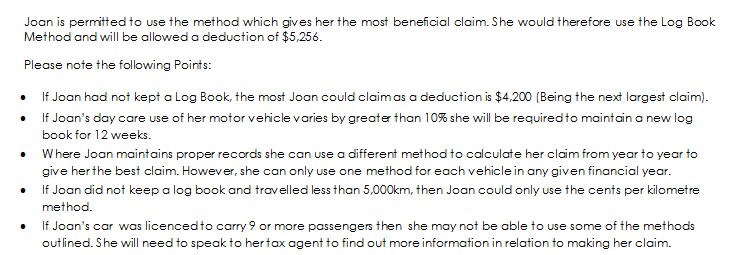

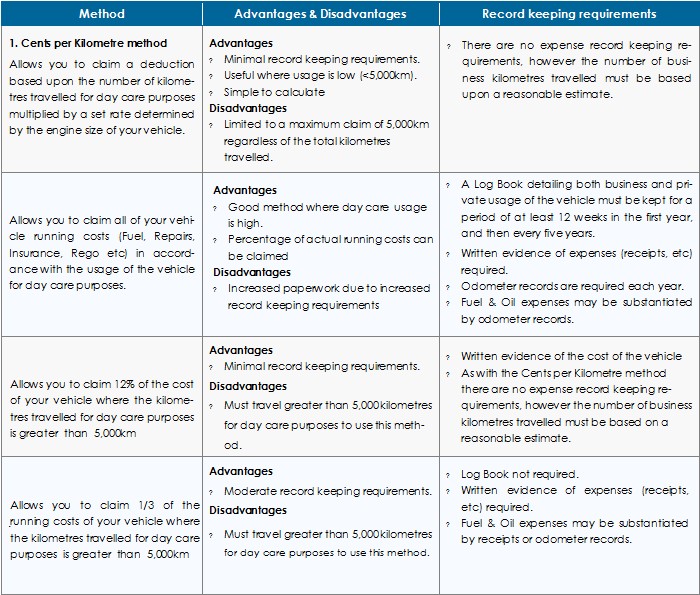

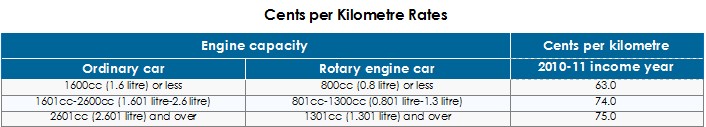

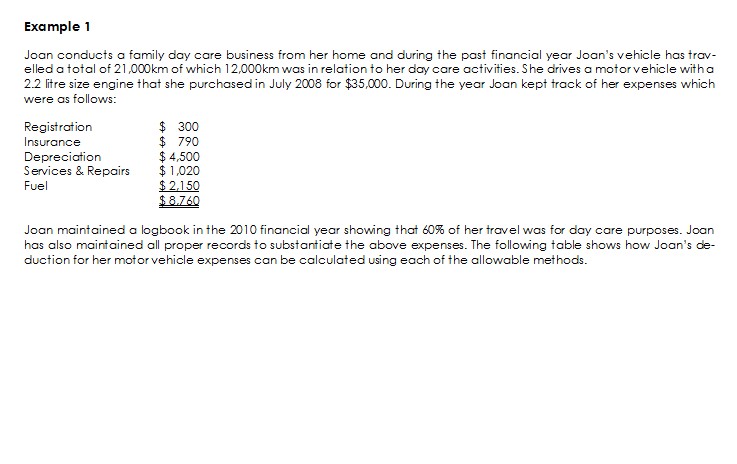

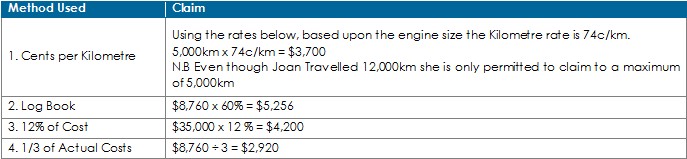

There are four methods you can use to calculate your tax deduction for your motor vehicle expenses. These methods are summarised in the table below:

There are four methods you can use to calculate your tax deduction for your motor vehicle expenses. These methods are summarised in the table below:

DISCLAIMER: the information contained in this tax tip are general comments only and do not constitute or convey advice perse. Individuals should seek their own independent advice from a qualified advisor to ascertain how the taxation law applies in their individual circumstance. The information contained is given in good faith and is believed to be accurate. However, neither Childcare Accounting & Financial Services nor any of its employees give any warranty of reliability or accuracy nor accept any responsibility in any way including by reason of negligence for errors or omissions herein.